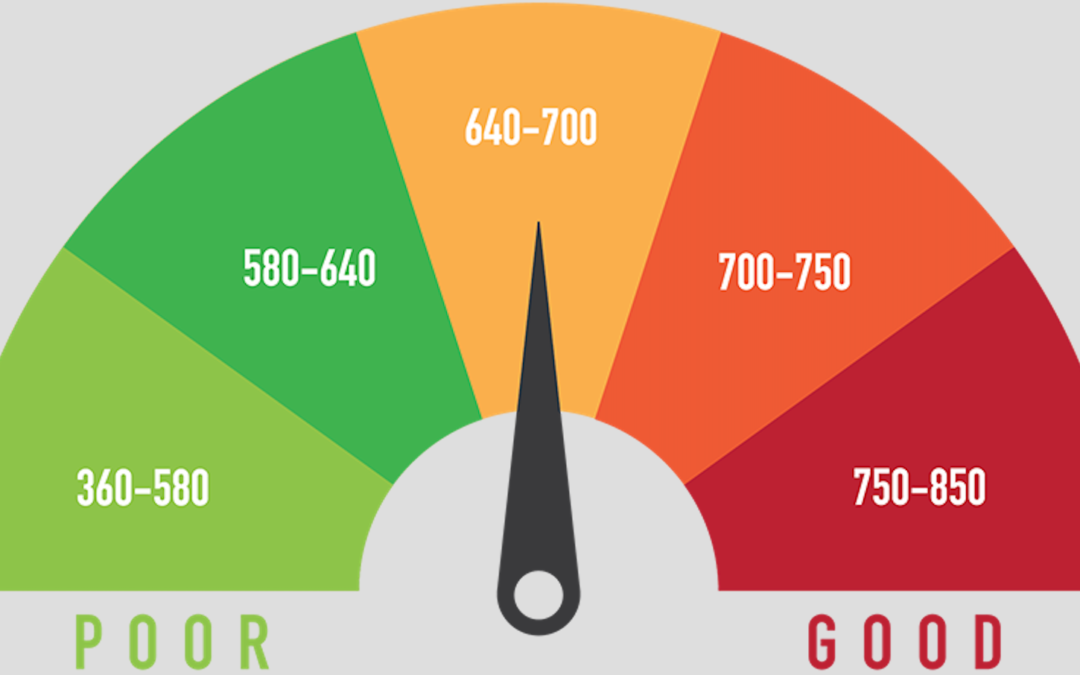

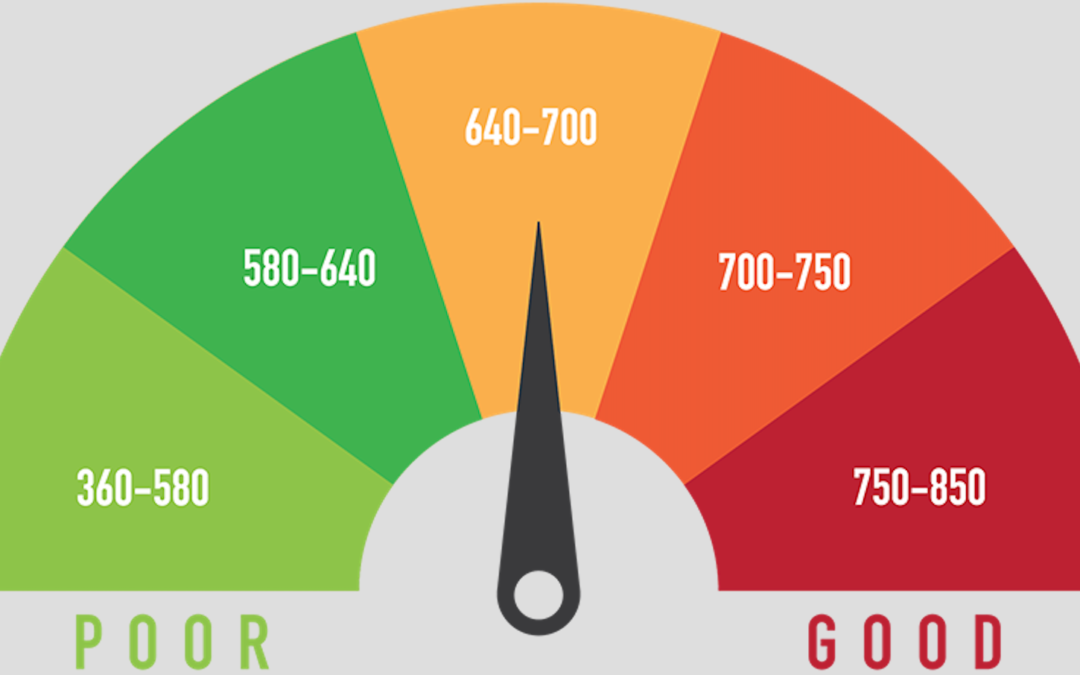

7 Steps to Take to Improve Your Credit Score

by Bruce Smith | Aug 9, 2019 | Blog

Your Credit… 7 Steps you can take to improve your score:

- Pay your personal & business bills On Time! Paying over 30 days late can drop your score up to 100 pts.

- Get credit for making utility & cell phone bills on time.

- Through the new opt-in product, “Experian Boost”, consumers can allow Experian to connect to their bank accounts to identify utility and telecom payment history.

- Pay off debt & keep balances low on credit cards & other revolving credit.

- Apply for open new credit cards only when needed.

- Do Not close unused credit cards – may increase your credit utilization ration.

- Don’t apply for too much new credit over a short period of time resulting in multiple inquiries.

- Check your credit report & score every 4 months for any inaccuracies

Remember:

- Delinquencies remain on your credit report for seven years.

- Most public record items remain on your credit report for 7-10 yrs.

- Inquiries remain on your report for two years.

- Be patient, rebuilding your credit takes time!

Contact:

Brian Breslin

(404) 845-7473